Bankruptcy & Restructuring Hotline™

CANADIAN BANKRUPTCY & RESTRUCTURING HOTLINE™

LOWER DEBT OBLIGATIONS BY UP TO 80%

Protect your assets and investments from creditors and lawyers

Lower the total debt owed and the total payments due on unsecured debt

Eliminate interest rate (0%( and pay off all unsecured debt within 5 years

Protect your business and personal assets from seizure and liquidation

Discover how to restart your life after a bankruptcy or consumer proposal

Two decades ago, creditors pierced my entities, seized by assets, and flushed me clean - I lost everything!

Since then, I've been fighting big banks, insurance companies, and aggressive creditors to help consumers protect and preserve their hard-work, sacrifices, and assets.

Hi, I’m Sid Peddinti, TEDx Speaker, Forbes & Entrepreneur Contributor, International Business & Tax Lawyer, and founder of The Legal Watchdog™ - a nonprofit organization on a mission to help consumers learn the law, avoid scams, and protect their assets from all sides.

In 2001, I launched a bakery in Mississauga, while attending UoT and studying business. It was a massive success and we eventually hit over a million a year in sales. But, this success was short-lived! I acquired loans and lines of credit from all the big banks and had financed all sorts of industrial equipment - my bakery and manufacturing unit was on Dixie and Eglinton, close to the Pearson Airport - because they were my first customers. I was the primary supplier of roti, naan, paratha, tortillas, and other specialty flat-bread for Air Canada during the early 2000s.

But in 2005 - I was sued, my business and legal entities were pierced, my assets were seized and liquidated, and I lost everything in a brutal and life-changing consumer proposal and bankruptcy process. I worked with a set of trustees, and eventually ended up working at the trustee's office - I had to understand how bankruptcy and liquidation worked so I can avoid these mistakes.

Since then, we've helped over 10,000 people collectively, in Canada and the US, protect their assets from these types of processes. I'm an International Business & Tax Lawyer and have created a cross-border Law and Tax Restructuring Practice - leveraging the power of the law to protect hard-working business owners, investors, and consumers from internal and external threats.

I have taken multiple business, bankruptcy, and tax certification in Canada, studied law in the UK, and pursued a Masters in Business & Tax Law in the US, and travel around North America speaking, teaching, and sharing the various strategies that we have learned and discovered with consumers.

Welcome the Bankruptcy & Consumer Proposal Hotline™ - an unbiased and independent nonprofit that focuses on protecting consumer rights and helping people make the right decisions.

Canadian Bankruptcy & Consumer Proposals In A Nutshell™

1. There Are Four Main Players

You (the debtor), your creditors, the Licensed Insolvency Trustee (LIT), and the Bankruptcy Court.

The trustee is a court-authorized collector - not your representative.

2. The Trustee’s Role is Dual

They assess your finances, file documents, and collect payments.

But they’re also paid 20% of what you pay - so higher proposals mean higher trustee fees.

3. You’re Not Alone - But You Might Feel Like It

Your creditors have lawyers and collection agents. The trustee is neutral.

You need someone in your corner to give you a second opinion before signing anything.

4. We Offer Strategic Second Opinions

Not legal advice - but unbiased, research-backed evaluations of what you owe, what’s protected, and whether bankruptcy or a consumer proposal is the smartest path.

5. We Look at the Full Picture

Assets vs. liabilities. Income vs. expenses. What’s seizable vs. exempt.

We help you understand all sides of your financial and legal position—before you commit.

6. There May Be Better Options

We often uncover ways to reduce debt further, restructure assets, or explore strategic alternatives to bankruptcy.

Most trustees won’t explore those paths for you.

7. We Help Business Owners Too

Have a company, side hustle, or investment account?

We’ve helped over 10,000 people restructure around real estate, business, insurance, and retirement funds.

8. We Provide Tools to Start Over

Looking to increase income or create a new online business after filing?

We offer guidance, templates, and education to help you build again - stronger.

9. Filing Can Help You Rebuild

Yes, it’s hard. But it also stops garnishments, freezes interest, and erases debt.

You can rebuild credit, regain control, and start fresh - often faster than you think.

10. Most People Are Misled

High-commission agents, debt settlement companies, and even some trustees have conflicting incentives.

We’re here to protect you from that risk.

11. We Don’t Get Paid to Recommend Anyone

No kickbacks. No hidden fees. No affiliate commissions.

We refer to professionals we’ve vetted - and only when you ask.

12. We’re Here for the Small Guys - Because We Were Too

Founder Sid Peddinti went through bankruptcy himself and rebuilt through strategy, education, and public service. Now, our nonprofit offers what we wish we had:

🔍 Free evaluations

📋 Second opinions

🧠 Strategic insight

🛡️ Consumer protection

Frequently Asked Questions

What is a Consumer Proposal?

What is a Consumer Proposal?

A consumer proposal is a formal debt settlement process governed by Canada’s Bankruptcy and Insolvency Act. You work with a government-licensed professional called a Licensed Insolvency Trustee (LIT) to offer your creditors a reduced repayment plan, typically over a 5-year period. If the creditors accept, the remaining debt is legally written off.

How does a consumer proposal differ from bankruptcy?

Consumer Proposal

- You keep your assets

- Credit rating is R7

- Repay part of your debt

- Monthly payments based on income, net worth, and an settlement offer

Bankruptcy

- You may lose non-exempt assets

- Credit rating is R9

- Often repay less, but surrender more

- Payments can increase with income

What debts can be included?

What debts can be included?

Unsecured debts like:

Credit cards

Lines of credit

Payday loans

Personal loans

CRA tax debt

Student loans

Secured debts (like mortgages and car loans) are not included - unless the property is in foreclosure

CEBA loans (Canadian Emergency Business Account)

Who is the Licensed Insolvency Trustee, and what do they actually do?

The Licensed Insolvency Trustee (LIT) is a neutral third-party appointed by the court. They:

Assess your income, assets, and debts

Recommend bankruptcy or a consumer proposal

File your documents and notify creditors

Collect payments from you and distribute them to creditors

Receive a 20% commission on all money collected

📌 Important: The trustee is not your personal advocate.

- They are legally bound to serve the interests your creditors.

- That’s why it’s wise to get an independent second opinion before filing.

Why does The Law and Tax Hotline™ offer “second opinions”?

Why does The Law and Tax Hotline™ offer “second opinions”?

Because most people don’t know this:

✅ Trustees are compensated more when you offer to repay more

✅ You may be advised to pay $40,000 when creditors would have accepted $20,000

✅ Many trustees don’t explore legal exemptions, tax options, or ways to protect assets

We offer research-backed, pressure-free evaluations so you can understand:

How much you really need to pay

What your exempt vs. seizable assets are

Whether better options exist to restructure, defer, or discharge debts legally

How CRA, business loans, and even family obligations are treated under the law

What are Trustee Fees, and do I have to pay them directly?

What are Trustee Fees, and do I have to pay them directly?

No, you do not pay the trustee separately.

Their fee is built into your monthly payment in a consumer proposal.

By law, a trustee receives:

A filing and administration fee (typically $1,500)

20% of all money you agree to pay through the proposal

So if you offer to repay $30,000, the trustee keeps $6,000 and creditors receive $24,000.

It's possible that the total amount could have been settled for as little as $10,000 or $15,000, instead of the $30,000. We've encountered thousands of such instances, and that's the reason why we created this Bankruptcy & Restructuring Hotline™ - to help you get independent and unbiased second opinion - so you can make informed, educated, and calculated decisions - leveraging the law ethically and in compliance at the same time.

What if I have assets like a business, investments, or property?

That’s exactly why you should talk to us.

We help you evaluate:

Which assets are exempt by law

How to legally protect your investments, insurance, real estate, and income streams

Whether it’s smarter to sell, restructure, or use a nonprofit or foundation model

We don’t just look at “debt.”

We help you connect the dots between law, tax, and finance—so you don’t lose more than you need to.

Can you help if I’m already in a consumer proposal or bankruptcy?

Yes.

We help people who are:

- Midway through a consumer proposal

- Facing challenges with their trustee

- Reconsidering whether bankruptcy was the right move

- Looking for post-filing strategies to rebuild credit, income, or legal structure

Do you give legal advice?

No. We are an educational and research-based initiative- but we can point you to the right experts who can help you, if needed.

We offer:

- Case law and tax code–backed second opinions

- Insight reports and strategic recommendations

- Referrals to licensed professionals who can legally represent you (including trustees, consultants, counsellors, or lawyers that we have worked with over the last 20 years and have found to be fair and flexible in their approach, not solely focused maximizing the earning on the "trustee fee").

- Support you can verify with laws, codes, and public records

Although we do nt provide legal advice, we have formed a vast community of professionals who can support you, where needed.

Why does your service exist?

Why does your service exist?

Because too many people are making life-altering financial decisions without understanding their rights, protections, or options.

We’ve seen:

Creditors take advantage of confusion

Trustees push one-size-fits-all settlements

People surrender their homes, retirement, and businesses unnecessarily

We’re here to protect consumers and enhance what’s possible.

What does it cost to get your help?

What does it cost to get your help?

Generally - Nothing.

But - we do offer a range of consulting and mentorship programs where we do charge a small fee.

Also, occasionally, we do charge a small fee for workshops and events that we host.

All prices or cost will be discussed or provided, where applicable, so you have the opportunity to make an educated, calculated, and well researched decision.

The Law and Tax Hotline™ offers a combination of:

Free assessments

Free calculators

Free second opinions

Free referrals (if needed)

List of resources and legal cases

No pressure.

No sales.

Just research-backed help from people who’ve been there.

Is there a cost when working with referral partners and providers?

Maybe. It depends on who you choose and what you need.

Some of our referral partners donate their time, tools, or knowledge—offering pro bono consultations, reports, or education as part of our nonprofit mission.

Others may offer their services at a discounted rate, especially for those referred through our platform.

You may encounter:

- Free strategy sessions or assessments

- Access to courses, templates, or legal tools

- Reduced-rate legal or tax services

- Software or planning systems at member pricing

We do not endorse or prioritize one provider over another.

Our role is to guide you to options and let you decide what fits best.

At a minimum, we always provide:

✅ Free assessments

✅ Free calculators

✅ Free second opinions

✅ Free referrals (if needed)

✅ No pressure. No sales. Just real, research-backed help.

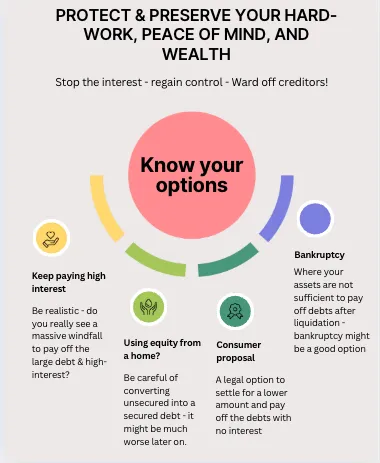

Protect and preserve your hard-work, sacrifices, peace of mind, and the wealth you've accumulated!

Stop the high-interest madness and let's make a plan to move on...

Step 1: Identify present liabilities

The first step generally involves examining your current credit and loan obligations - secured and unsecured debts and obligations.

Step 2: Identify present assets

Next, we identify the assets that are exempt from creditor action and those that they can reach if they sue you. This now gives us the options at hand.

Step 3: Identify all your options

The next steps is to evaluate what options you have right now vs in the future - should you get a loan, consolidate, refinance, get a second mortgage?

Step 4: Pick and choose the right option

With all of these options spread out in front of you like a puzzle - you can now make informed, calculated, and highly evaluated decisions.

Fill out a short "Income & Expense", "Liability & Asset" Assessment and Evaluation Form

100% Complimentary & Pro Bono Session: Our Gift To You!

Important Disclaimers:

No legal, financial, or tax advice given, contained, or offered in any way.

No attorney-client relationship is created, should be assumed, or is implied in any way, whatsoever.

This is a 100% FREE, complimentary, research-based brainstorming call.

We are an educational research center, not a law, tax, trustee, or financial service company.

Your information is 100% confidential, private, and will not be shared, published, or sold to any third parties.