estate planning hotline™ - a pro bono service by the legal watchdog™

Get A Complimentary "Estate & Tax" Evaluation

Get An Unbiased, Independent, and Research-Oriented "Second Opinion" That Covers:

Common Leaks And Gaps In Estate Plans

Alignment Of Law, Tax, and Finance Teams

Aligning Business, Personal, and Investment Plans

Evaluating Hidden Layers Of State & Federal Taxes

Estate And Tax Cases & Codes™ That Apply To You

Let me ask you a few questions...

Do you possess the knowledge, training, or education to make educated estate planning decisions?

Do you know how a will vs trust are treated at death, and what forms need to be filed with the state or IRS?

Has your estate planning lawyer or accountant reviewed a "death tax return" form with you?

Do you know the nuances of the terms contained in your will or trust and what the outcomes will be?

Does your spouse, partner, or family member know how to manage your estate and investments?

Has your estate planning lawyer or accountant reviewed how these taxes are computed:

Income tax (included deferred accounts)

State inheritance or gift tax limits

Probate process and costs involved

Gift, estate, and generation-skipping-tax

How insurance policies, investments, and assets are taxed or not taxed

What specific "rules, tests, and standards" (cases and codes™) the state or federal agencies or courts will adopt and use when evaluating your final taxes?

How will your business interests and share value be computed at your death?

How are gifts made to others, including irrevocable trust structures treated?

What about insurance - is it 100% exempt from all those layers of taxes? Are you sure?

We an go on and on, but I think you see the point - estate planning is a very complex topic that intertwines with almost every other area of law.

If you possess a diversified portfolio of assets, businesses, and income streams - there's a good chance that many of these questions are directly going to impact you, whether you know it or not.

Over the past two decades, we've worked with over 10,000 people in diverse capacities, and have realized that in the lion's share of cases, the advisors teams representing the same person have NEVER spoken to each other, let alone operate in aligning - which causes lots of "gaps and holes" in the estate startegies.

These are the gaps that cause BIG surprises later down the line - unpaid estate or gift tax.

These are the gaps that scammers and fraudsters have become experts in exploiting.

These are the gaps that cause your beneficiaries to end in up bitter family or tax-related lawsuits.

Our mission is to protect consumers from these mistakes.

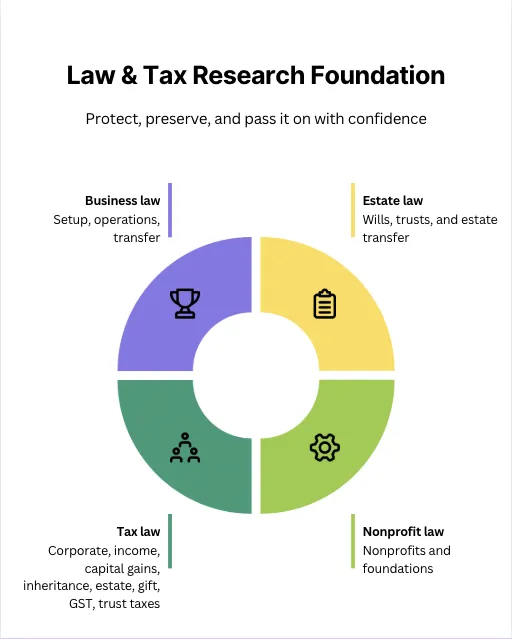

We conduct deep BENT LAW™ (Business, estate, nonprofit, and tax™) research and help people make informed choices and decisions. Here are a few examples of what we are talking about...

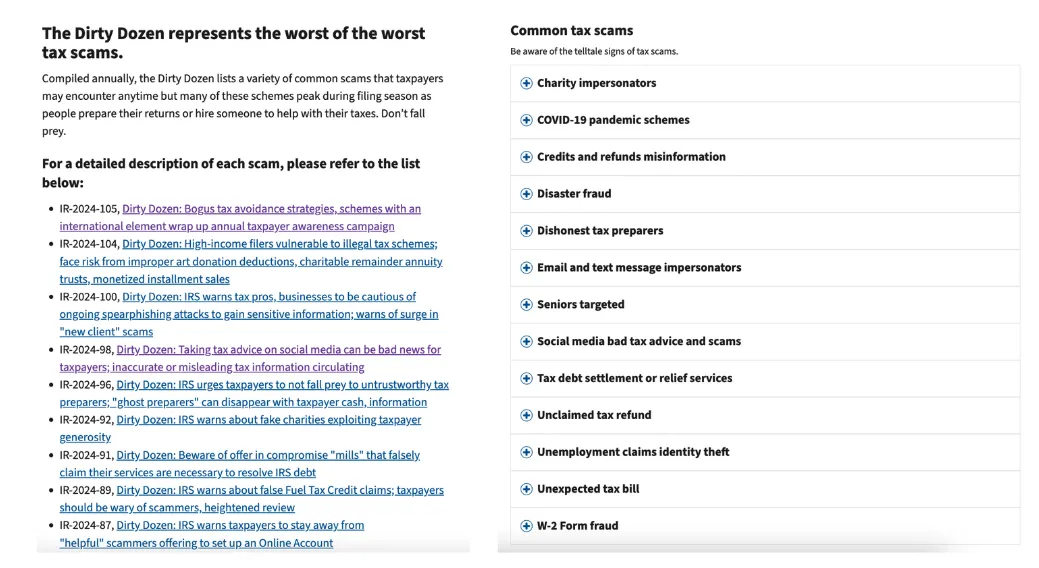

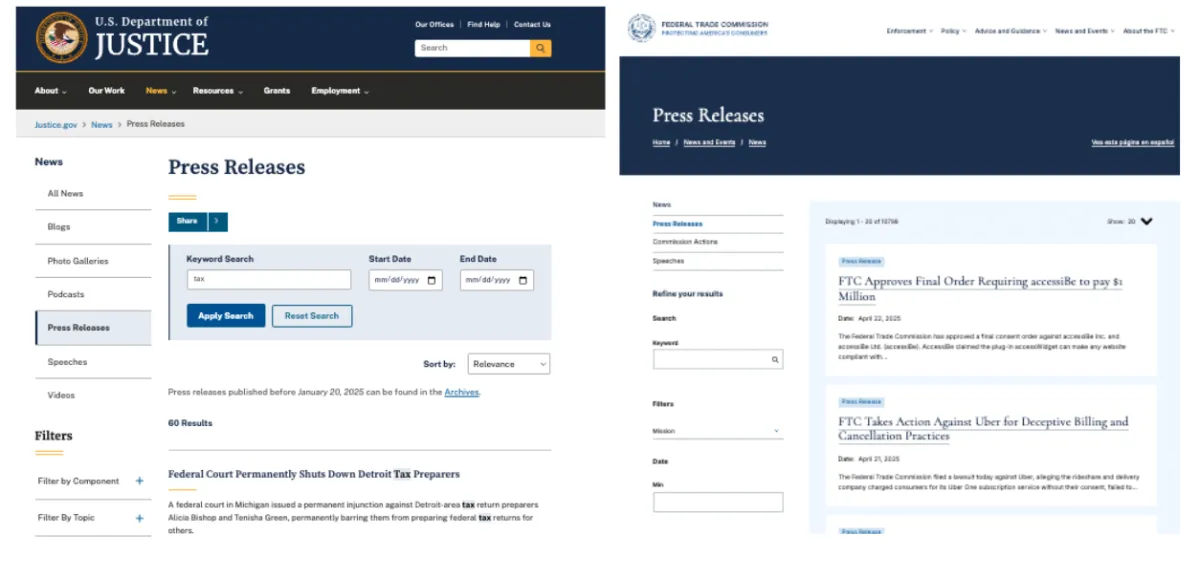

The IRS publishes a list of scams called the Dirty Dozen List to warn consumers and protect the public - but there are hundreds of sophisticated scams that don't end up here.

Th IRS, DOJ, FTC, and other agencies are fighting these scammers and fraudsters, but many slip through the cracks - that's why we created the LEGAL WATCHDOG - to educate & empower people so they don't lose their peace of mind and wealth to these scams.

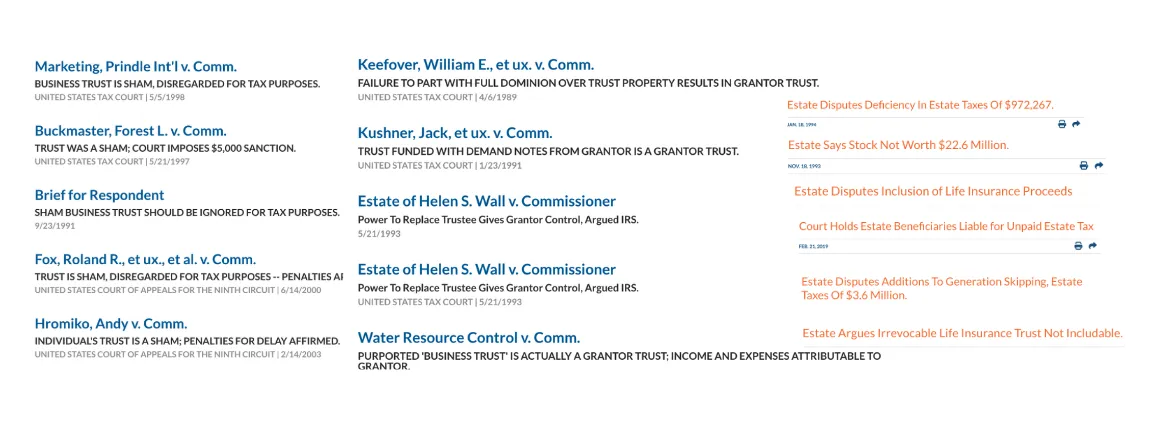

Imagine if your beneficiaries and loved ones being involved in these types of lawsuits...

Decades worth of hard-work can be wiped out in a fraction of the time without planning.

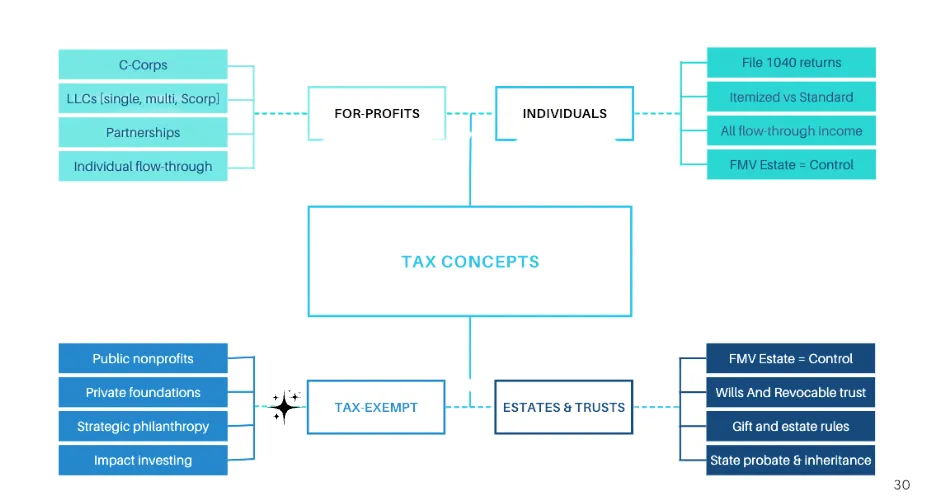

Think of all the experts on your team, working on various components, each one disconnected with the other, and the gaps that can emerge by not creating a unified and aligned game plan.

Welcome To The Legal Watchdog™

We're here to protect consumers, protect providers, and crack-down frauds and scams that are destroying the hard work and sacrifices that we have made to get to this stage!

Before we dig deeper - let me introduce myself.

My name is Sidhartha "Sid" Peddinti - I'm a Business Philosopher, TEDx Speaker, Contributor, Tax Researcher, and International Business & Tax Attorney.

I'll be the first to admit:

- I have been scammed.

- I have been fooled.

- I have made big decisions without any knowledge on the topics.

And...

I have even been BANKRUPT.

My business and personal assets have been seized and liquidated.

I have had to restart due to poor decisions.

In 2005 - the banks crushed my business, pierced my entities, and flushed me clean despite having the top lawyers, accountants, and financial experts on my team. They never met each other, aligned their strategies, or took the time to look at the "big picture" with me - and those were the gaps that the banks could pick apart.

MILLIONS of people get caught up in these types of situations every year - and it's mostly due to the following factors:

(a) The lack of knowledge on important legal, tax, and financial topics that all flow together

(b) The false sense of belief that an "estate or tax planning" decision has to be made - so you make bad ones that do more damage.

(c) Approaching law, tax, and financial matters in a reactive manner - where you are responding and reacting, not proactively learning and planning.

I have bought all sorts of LLCs, partnerships, trusts, and various investment and insurance programs that left me in a much worse of position than where I started.

MY mission since my own bankruptcy in 2005 has been to discover, uncover, investigate, and share the laws, regulations, strategies, and tools that can help individuals, entrepreneurs, and investors protect their wealth, make educated decisions, and avoid scammers and fraudsters who are lurking around on social media waiting and hunting for their next victim.

Here's what our research shows:

After 20 years of research, 10,000+ legal cases under our belt, and over tens of thousands worth of research - our research shows:

The wealthiest individuals don’t rely on one structure - they use them all as needed.

They use Bruce Lee’s principle: “Be like water” - fluid, strategic, always adjusting, not stuck with one strategy.

They integrate philanthropy - not just for impact - but for control, tax leverage, and legacy.

They align the legal, financial, and business ecosystems like a Mini Family Office™, even if they don’t call it that.

That is the structure that we have been teaching consumers, business owners, and their advisory teams to incorporate - a unified and aligned approach where ALL their advisors are working in unison from ONE playbook.

We Share Our Insights In Various Forms To Educate & Empower People

Presentations, Keynotes, Courses, Programs, Workshops, Webinars, TEDx Talks, Articles featured across Publications Like Forbes, Success, Entrepreneur, CEO World, Thrive Global, MBA Alternative, and hundreds of masterminds and seminars

Get An Unbiased & Independent Second Opinion - No String Attached.

Important Disclaimers:

No legal, financial, or tax advice given, contained, or offered in any way.

No attorney-client relationship is created, should be assumed, or is implied in any way, whatsoever.

This is a 100% FREE, complimentary, research-based brainstorming call - we are researchers and educators.

We are an educational research center, not a law, tax, or financial service company.

Your information is 100% confidential, private, and will not be shared, published, or sold to any third parties.

Please make sure to fill out the application form BEFORE attending your pro bono session - we will cancel the appointment if we do not receive an intake survey form before the meeting.